Are you an investor of Debt Mutual Funds? If so, then you might have heard about the credit risk. However, you may surprise with an idea of how such credit risk be utilized by debt mutual funds. These Credit Opportunities Funds are new types of funds, which utilize the credit opportunity.

Credit Opportunity Fund

Before proceeding further, let us first understand a few basics of Debt Funds or Bond Market.

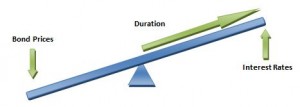

Bond Price Vs Interest Rate

Let us say currently SBI Bank offering you the FD at a 9% interest. If someone offers you a bond, which gives you a yearly coupon of 10%, then you definitely look forward to buy this bond rather than FD. Therefore, when many will chase to buy the bond, which is offering a 10% coupon, then definitely the price of a bond will increase.

This is the effect of interest movement on bond price. Higher the interest rate means lower the bond and vice versa.

Bond Yield

Yield is a measure of interest income generated by a bond. The formula to calculate a Yield is as below.

Yield=Coupon Amount/Bond Price.

Let us say you are holding a bond with a price at Rs.100 and giving you an annual coupon of Rs.10. In this case, the yields will 10%. Let us say, due to an increase in interest rate, the bond price decreased to Rs.90 then the yield will be increased by 11.11%. At the same time, let us say, due to fall in an interest rate, the bond price increased to Rs.110 then the yield will be Rs.9.09%

Which is profitable for you? Investing Rs.100 bond and getting a coupon of Rs.10 or investing in Rs.90 bond and getting the same coupon of Rs.10? Obviously the Rs.90 bond. Hence, lower the bond price means higher the yield and vice versa. You notice that a bond price is inversely proportional to yield.

For bond funds, the weighted average of a portfolio of bond yield is calculated. This is called as yield to maturity. Yield to maturity is an expected yield, which you receive if you hold the bonds in the portfolio until maturity.

Modified Duration–

This is a measurement of bond’s sensitivity to interest rate movement. It is measured in years. Let us say, the modified duration of a bond or bond fund is 5 years, then for any interest rate movement of 1% the bond price or NAV of a bond fund will move to 5%. The longer the modified duration, higher the sensitivity to interest rate movement. Hence, you have to choose the lower modified duration bond or fund.

Average Maturity–

As the name indicates, it provides you an average maturity of all bonds held in a portfolio of funds. Higher the average maturity means the higher the risk of interest. Therefore, you have to look at underlying bond fund average maturity before going for investing.

Accrual strategy of Fund (Credit Risk Strategy)

The major intention of such funds is to provide a better return. They usually not bother about the interest rate cycle. However, they try to provide you had better return by holding low duration and low-rated corporate bonds. Along with that, they may generate higher yield if the corporate bond rating goes up and ultimately that effect in an increase in the price of a corporate bond. Overall resulting in higher yield.

Therefore, in accrual strategy, the fund manager will try to provide a better return by indulging in buying of corporate bonds (which may be low in credit rating). Here the intention is clear; to hold the bonds, which provide high yield irrespective of credit rating. However, there is a risk of default due to low credit rating.

Duration Strategy of Fund (Interest Rate Risk Strategy)–

If a fund manager takes a duration strategy based on interest risk, then such strategy is known as duration strategy. For example, if an interest rate drops then the fund manager tries to hold long maturity bonds and at the same time if an interest rate raises, then he adjusts to short-term maturity bonds.

Therefore, they increase the duration if the interest rate falls and do vice-versa when interest rate rises.

What are credit opportunities funds?

They are Debt Mutual Funds. Credit opportunities funds adopt the accrual strategy to provide the better return. They take the credit risk for the sake of generating high yield. Usually, they invest in low credit rated funds like less than “AA” rated. Lower the credit rate leads to higher the return. Because the risk of default also increases.

Here you will find two types of opportunities for a fund manager to provide better returns. One is holding the low-rated corporate bonds. The second is, if a company performs well then the same credit rating agency may grade it higher. In such a situation, the price appreciation will definitely effect into a better return from such funds.

Ideally, fund managers not only look for a current credit rating, but also at the health of a company. If the company has a huge opportunity to grow, then it turns to be the best choice for a fund manager.

Whether it is best to hold such funds?

Why we all hold debt funds? The main idea is to cushion the risk of what we have already in equity investment by diversifying properly. Therefore, I do not think it is good to hold such funds and borne more risk. The risk I have in equity is enough and no more risk from debt funds too. Hence, I stick to short-term goals than any such type of experimental strategy