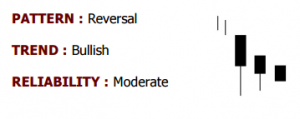

- Bullish Stick Sandwich

Identification:

First day is a black body candle

Second day is a white body candle that trades above the closing of first day

Third day is a black body candle with close equivalent to first day

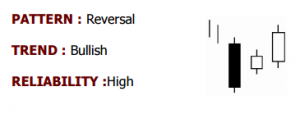

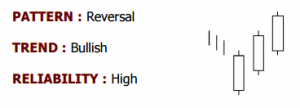

- Bullish Three Inside Up

Identification:

A bullish harami pattern in the first two days

Third day is a white body candle with a higher close than second day

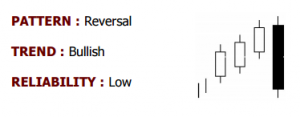

- Bullish Three Line Strike

Identification:

Three long white body candles with consecutively higher closings

Fourth day opens higher and closes below the open of the first day

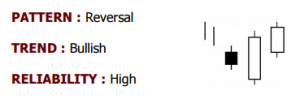

- Bullish Three Outside Up

Identification:

A bullish engulfing pattern occurs in first two days

Third day is a white day with higher close than second day

- Bullish Three Stars in the South

Identification:

First day is a long black body candle with long lower shadow

Second day is black body candle similar to first day, but smaller, with a low above the first day’s low

Third day is a small black Marubuzo that lies within the second days trading range

- Three White Soldiers

Identification:

Three long white body candles, each with higher close than previous day

Each day opens within the body of previous day and closes near the day’s high

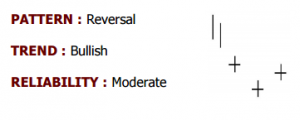

- Bullish Tri Star

Identification:

A doji occurs on three consecutive trading sessions

Second day’s doji gaps below the first and third day

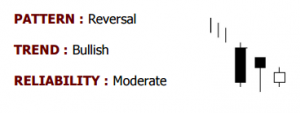

- Unique Three River Bottom

Identification:

First day is a long black body candle

Second day is a black harami day, with a shadow that sets new low

Third day is a short white body candle which closes below the closing of second day

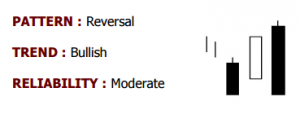

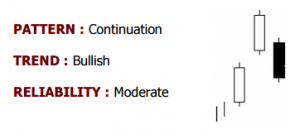

- Bullish Upside Gaps Three Method

Identification:

Two long white body candles with a gap between them

Third day is a black body candle that fills the gap between the first two days

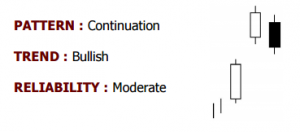

- Bullish Upside Tasuki Gap

Identification:

The first two days are white body candles with an opening gap

Third day is a black body candle that opens within the body of second day and closes within the gap of first two days