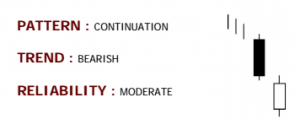

- Bearish In Neck Line

Identification:

First day is a long black real body candle

Second day is a white body candle the opens below the low of previous day but closes barely above or equal to the closing of previous day

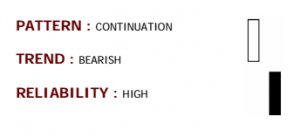

- Bearish Kicking

Identification:

First day is a white Marubuzo candle

Second day is a black Marubuzo candle that gaps downwards

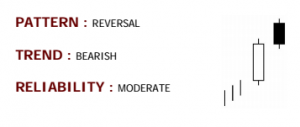

- Bearish Meeting Lines

Identification:

First day is a long white body candle, and has a body that is above the previous trend

Second day is a black real body candle, and has a body that is above the previous trend

Both days have identical closes

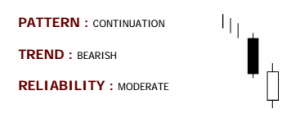

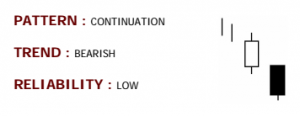

- Bearish On Neck Line

Identification:

First day is a long black real body candle

Second day is a white real body candle that opens below the low of the previous day and closes at the low of previous day

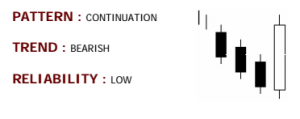

- Bearish Separating Lines

Identification:

First day is a white real body candle

Second day is a black body candle that has the same opening price as the first day

- Bearish Side By Side White Lines

Identification:

First day is a long black real body candle

Second day is a white body candle that gaps down

Third day is a white body candle of about same body length and close as the second day

- Bearish Three Inside Down

Identification:

A bearish harami in the first two days

Third day is a black body candle with a lower close than the second day

- Bearish Three Line Strike

Identification:

Three long black body candles with consecutive lower closes

Fourth day opens lower but closes above the open of first day

- Bearish Three Outside Down

Identification:

A bearish engulfing pattern occurs in the first two days

Third day is a black body candle with a lower close than the second day

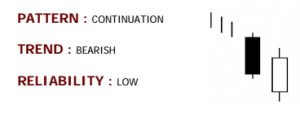

- Bearish Thrusting

Identification:

First day is a long black real body candle

Second day is a white body candle that opens below the low and closes into the body of previous day, but below the midpoint

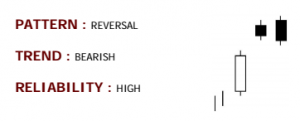

- Bearish Tri Star

Identification:

Doji on three consecutive trading days

Second doji gaps above the first and third

- Bearish Two Crows

Identification:

First day is a long white body candle

Second day is a black body candle that gaps above the first day

Third day is a black body candle that opens within the body of second day and closes within the body of first day

- Bearish Upside Gap Two Crows

Identification:

First day is a long white body candle continuing in an uptrend

Second day is a black body candle and gaps up

Third day is also a black body candle which engulfs the previous black body candle but still closes above the second day