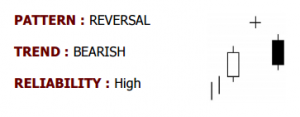

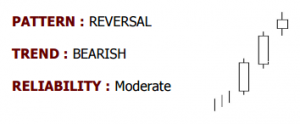

- Bearish Abandoned Baby

Identification:

First day is usually a long white body candle

Second day is a doji that gaps in the direction of the previous trend

Third day is a black body candle which gaps in the opposite direction with no overlapping shadows

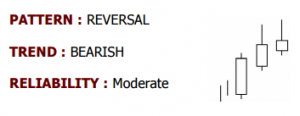

- Bearish Advance Block

Identification:

Three long white body candles, each with higher closing than previous day

Each day opens within the body of previous day and closes near the high of the day

Each day’s body is significantly smaller than the previous day’s body

The second and third days should exhibit long upper shadows

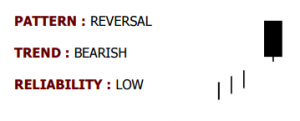

- Bearish Belt Hold Line

Identification:

A black body candle which occurs in an uptrend with no upper shadow

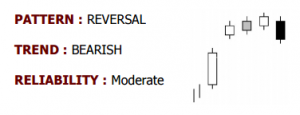

- Bearish Breakaway

Identification:

The first day is a long white body candle

Second day is a white body candle that gaps above the first day

Third and fourth days continue in the direction of the second day with higher consecutive closings

Fifth day is a long black body candle that close sinto the gap between the first and second day

- Bearish Dark Cloud Cover

Identification:

First day is a long white body candle

Second day is a black body candle with opening above the first day and closing within but below the midpoint of the first day’s body

- Bearish Deliberation

Identification:

Two days of long white body candles, the second one with higher close than the first one

Third white body candle is a spinning top or doji that gaps above the second day

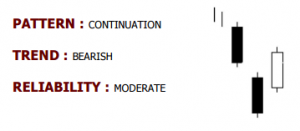

- Downside Gap Three Method

Identification:

Two long black body candles forms with a gap between them

Third day is a white body candle that fills the gap between the first two days

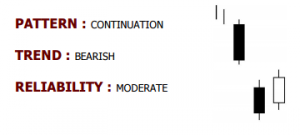

- Bearish Downside Tasuki Gap

Identification:

The first two days are black body candles with an opening gap

Third day is a white body candle that opens within the body of the second day and closes within the gap of first two days

- Bearish Doji Star

Identification:

First day is a long white body candle

Second day is a doji that gaps in the direction of the previous trend

The shadows of the doji should not be long

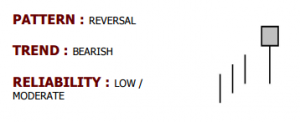

- Hanging Man/ Dragonfly Doji

Identification:

Small real body (no body in case of dragonfly doji) at the upper end of the trading range

Lower shadow at least twice as long as the real body

No (or almost no) upper shadow