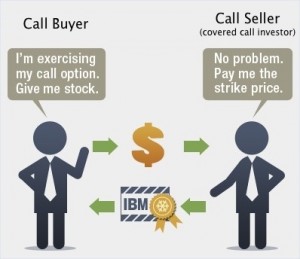

Calls

The right, but not the obligation, to buy a specific number of shares of the underlying security at a defined price, until the expiration date.

Puts

The right, but not the obligation, to sell a specific number of shares of the underlying security at a defined price until the expiration date.

Strike price

The price at which option holders can exercise their rights.

Exercise

The process in which the buyer of an option takes, or makes, delivery of the underlying contract.

Expiration

The time at which an option can no longer be exercised.

In the Money (ITM)

A call (put) option whose strike price is below (above) the stock price.

At the Money (ATM)

An option whose strike price is roughly equal to the stock price.

Out of the Money (OTM)

A call (put) option whose strike price is above (below) the stock price.

American style

An option that can be exercised at any time before expiration

European style

An option that can be exercised only at expiration. (Note: These are mainly index securities.)

Intrinsic value

The amount that an option is in the money.

Time value

The price of an option less the intrinsic value.

Option Chains

For any given option contract, we need to know the most recent prices and other factors. Option chains show data for a given underlying’s different strike prices and expiration months.

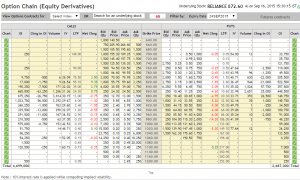

Options chain example

At the top, we have the stock information and then different expiration months. In this case we are looking at Reliance Industries Sep 2015 Contracts.

Down the middle are the strike prices. Calls are on the left, puts on the right.

Contracts in the money are yellow, and out of the money are white.

Each strike lists:

The price of the last trade (“LTP”)

The price at which there are willing buyers (the “Bid Price”)

The price at which a contract is offered for sale (the “Ask Price”)

The volume of the day’s trading (“Volume”)

The contract’s “open interest” (“OI”), which tells us how many active contracts there are for a given month and strike.

High open interest figures, generally near the at-the-money strikes, tell us there are more prospective trading partners who could accept your price. But note that volume does not equal open interest, since some trades are made to close positions.