Public Provident Fund

It is savings-cum-tax-saving instrument and it mobilizes small savings by offering an investment with reasonable returns combined with income tax benefits.

Unit Linked Insurance Plans

It is a product offered by insurance companies that unlike a pure insurance policy gives investors the benefits of both insurance and investment under a single integrated plan.

Mutual Fund

It is a type of professionally managed investment fund that pools money from many investors to purchase securities.

National Saving Certificate investment

It is an Indian Government Savings Bond, primarily used for small savings and income tax saving investments. It is part of the postal savings system of Indian Postal Service (India Post).

Infrastructure bonds

There are long term investment bonds issued by any non-banking financial company like Industrial Finance Corporation of India or IDF.

Employee Provident Fund

It is a form of social safety net into which workers must contribute a portion of their salaries and employers must contribute on behalf of their workers.

Equity-linked savings scheme

It is popularly known as ELSS. It is diversified equity schemes offered by mutual funds. It offers tax benefits. This type of mutual fund has a lock in period of three years from the date of investment.

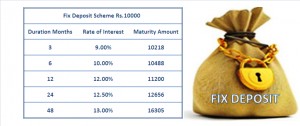

Fixed Deposits

It is a financial instrument provided by banks which provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

Senior Citizen Savings Scheme

It is Senior Citizen investment option to give higher returns compare to Fix Deposit.

Rajiv Gandhi Equity Savings Scheme

RGESS was introduced with the goal of encouraging savings from small retail investors to enter domestic capital markets. The scheme also aims at improving the retail participation in equity markets, and to promote an ‘equity culture’ in India.