October 29, 1929

News of a big U.S. monthly trade deficit on Oct. 14 sparked the crash of 1987. The Dow took the first 100-point dive in its history on Oct. 16, 1987, and would be hit harder on Oct. 19, or Black Monday, when it lost more than 500 points. The crash wiped 22.6 per cent off the value of the New York Stock Exchange, compared with 12.8 per cent on the worst day of the crash of 1929.

October 19, 1987

News of a big U.S. monthly trade deficit on Oct. 14 sparked the crash of 1987. The Dow took the first 100-point dive in its history on Oct. 16, 1987, and would be hit harder on Oct. 19, or Black Monday, when it lost more than 500 points. The crash wiped 22.6 per cent off the value of the New York Stock Exchange, compared with 12.8 per cent on the worst day of the crash of 1929.

October 27, 1997

Financial turmoil in Asia, which began in July when international currency speculators bet against the Thai baht, helped trigger the biggest single-day point decline in the Dow Jones industrial average on Oct. 27, 1997. Stock markets in Argentina, Mexico and Brazil dropped between 13 and 15 per cent. It spilled over into European markets on Oct. 28. Tokyo’s Nikkei 225 index fell 725.67 points, or 4.26 per cent, to 16,312.69.

September 11, 2001

The terrorist attacks on the United States on Sept. 11, 2001, triggered another global market crash. Investors across the world snapped up traditional safe assets, like gold and bonds, after the attack battered global stocks, shook the U.S. dollar and drove up oil prices. Main U.S. markets were closed after the attacks, which occurred blocks away from the New York Stock Exchange just as the trading day was about to begin. After a delayed opening, Tokyo stocks slid to 17-year lows, with the Nikkei stock average losing 6.23 per cent to 9,651.62 and breaching 10,000 for the first time since August, 1984. European stock indexes fell to their lowest levels since December, 1998. London’s FTSE 100 index shed 5.7 per cent in its biggest one-day fall since the crash of October, 1987, wiping $98-billion off the value of shares.

February 27, 2007

The Dow fell 3.3 per cent, or 416 points, after a collapse in Chinese stocks and weak U.S. manufacturing data. The Nikkei share average lost more than 3 per cent and the FTSE 100 was down 116.1 points, or 1.85 per cent. Mexican stocks lost 4 per cent and Chinese stocks plunged nearly 9 per cent, erasing about $140-billion of value in their biggest fall for a decade.

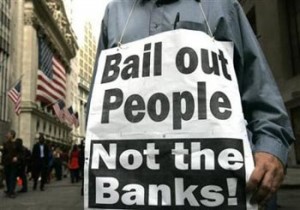

September 29, 2008

The rejection of a $700-billion bailout bill, which proposed the government purchase toxic mortgage-related assets from troubled financial institutions, by the U.S. House of Representatives sends global markets into a tailspin. After a month that saw the government seize control of mortgage lenders Fannie Mae and Freddie Mac, and the collapse, bailout and merger of some of Wall Street’s biggest banks, the Dow loses 429 points in just six minutes.

May 6, 2010

The Dow plunges nearly 1,000 points in 30 minutes, but would recover two-thirds of its losses by the end of the day. Later, the Nasdaq cancelled all trades that occurred during the drop.